Receipt Capture

Snap Receipts, Save Time, Stay Audit-Ready

Parachute reads your receipts automatically and keeps them stored, sorted, and ready for tax time — all in one place.

Capture Every Receipt in Seconds

Upload from computer, use phone or tablet to capture receipts from anywhere. Gas stations, restaurants, office supplies - Parachute read them all.

Details Scanned, Data Auto-Filled

Parachute autofill the date, amount, and payment info, and store a digital proof of purchase for your records.

Expense Saved with Digital Proof

All your receipts are stored, organized, and searchable. When tax time comes, everything’s already sorted.

Snap Receipts, Save Time, Stay Audit-Ready

Parachute reads your receipts automatically and keeps them stored, sorted, and ready for audit time — all in one place.

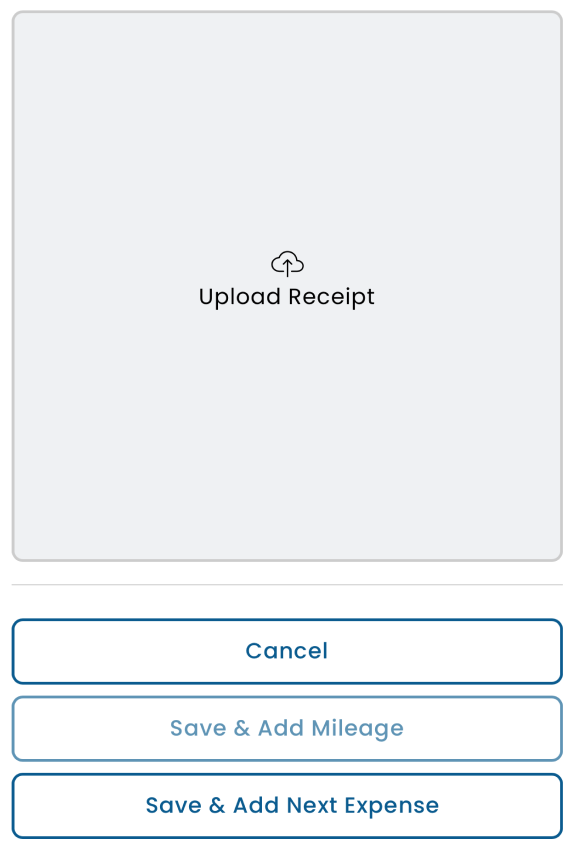

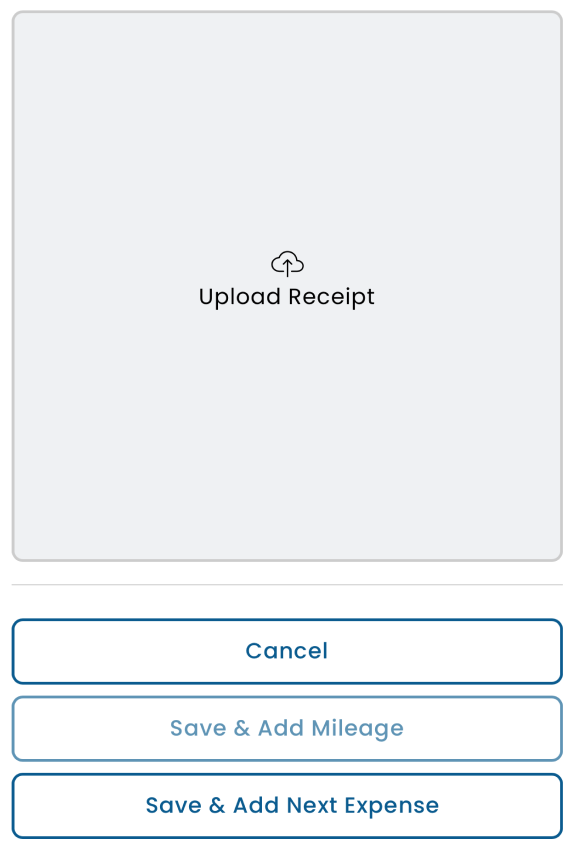

Capture Every Receipt in Seconds

Upload receipts for purchases like classroom materials, maintenance, or supplies — Parachute automatically reads and fills in key details. You’ll have clean, organized expense data without manual entry.

Categorize and Allocate with Accuracy

Assign expense to category and allocation type. Allocation tracking helps you report expenses by funding source or grant type — ensuring transparency and accuracy in your records with digital proof or the expense handy.

Access Your Expenses Anytime

All receipts and expenses are securely stored, searchable, and linked together — making it easy to find documentation when you need to verify purchases or review spending.

Try receipt capture free

Start your 30-day free trial for Parachute

Take advantage of Parachute features for smooth sailing to financial wellbeing:

Upgraded Attendance

Kiosk Mode

Signature Pick Up

PIN Check-in/out

QR Code

Parent App

Invoicing & Payments

Recurring Invoices

Online Payments & Autopay

Schedule Invoices

Splitting Invoices

Third Party Billing

Financial Tools

Financial Dashboard

Income Tracking

Expenses Recording

Financial Reporting

Inventory & Mileage Tracking

Parent Tools

Parent Payment Initiation

SMS & Push Notifications

Parent Portal

Messaging

Activity Log

FAQ

You absolutely can! If you have an active KidKare Accounting subscription, you can access Parachute with the same credentials.

Parachute is designed by the KidKare team to enhance the user experience and interface for greater success in managing your childcare business. Parachute integrates all the feedback, needs, and requests gathered from KidKare users to provide a seamless experience. It offers improved features for invoicing, managing income and expenses, calendar functions, a customizable dashboard, and various other enhancements to streamline childcare management tasks.

If you have KidKare Accounting subscription, you will be able to use both products.

Parachute has a monthly subscription of $15.50, and annual subscription of $125.

For childcare centers, Parachute has a monthly subscription of $34.99 and an annual subscription of $280.

Absolutely! Parachute is designed to empower your business and allows you to stay on top of your childcare business finances and performance. It allows you to send invoices easily, accept payments from parents and provides you all of the necessary tools, and tax reports for your business.

You can expense your subscription to Parachute as a business expense for tax purposes. Parachute is a valuable tool that helps you manage your childcare business finances effectively, making it an essential operating expense. Simply include the subscription fee as part of your business expenses when filing your taxes. If you have any questions or need further assistance with expensing your subscription, consult with your tax advisor or accountant for personalized guidance.